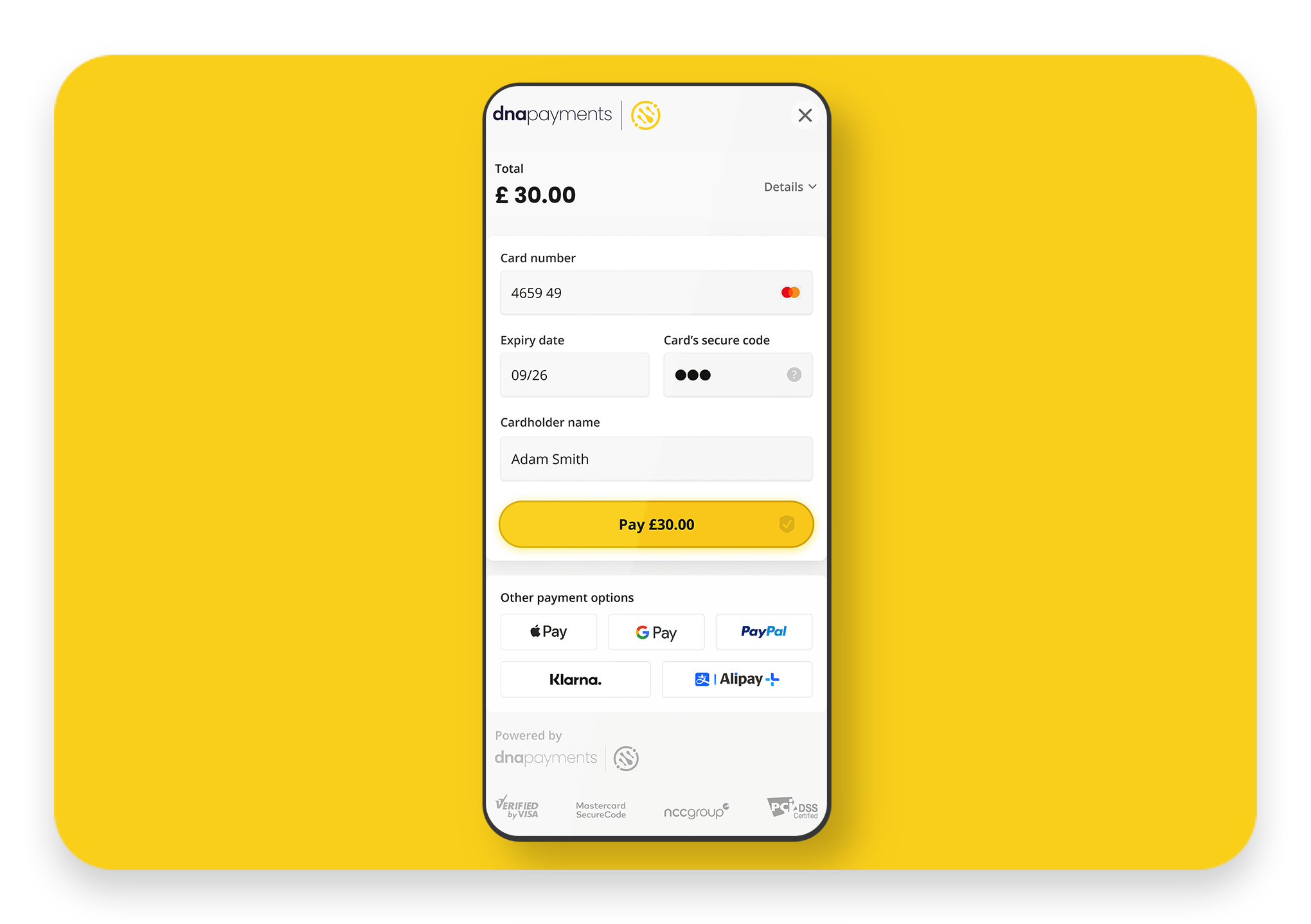

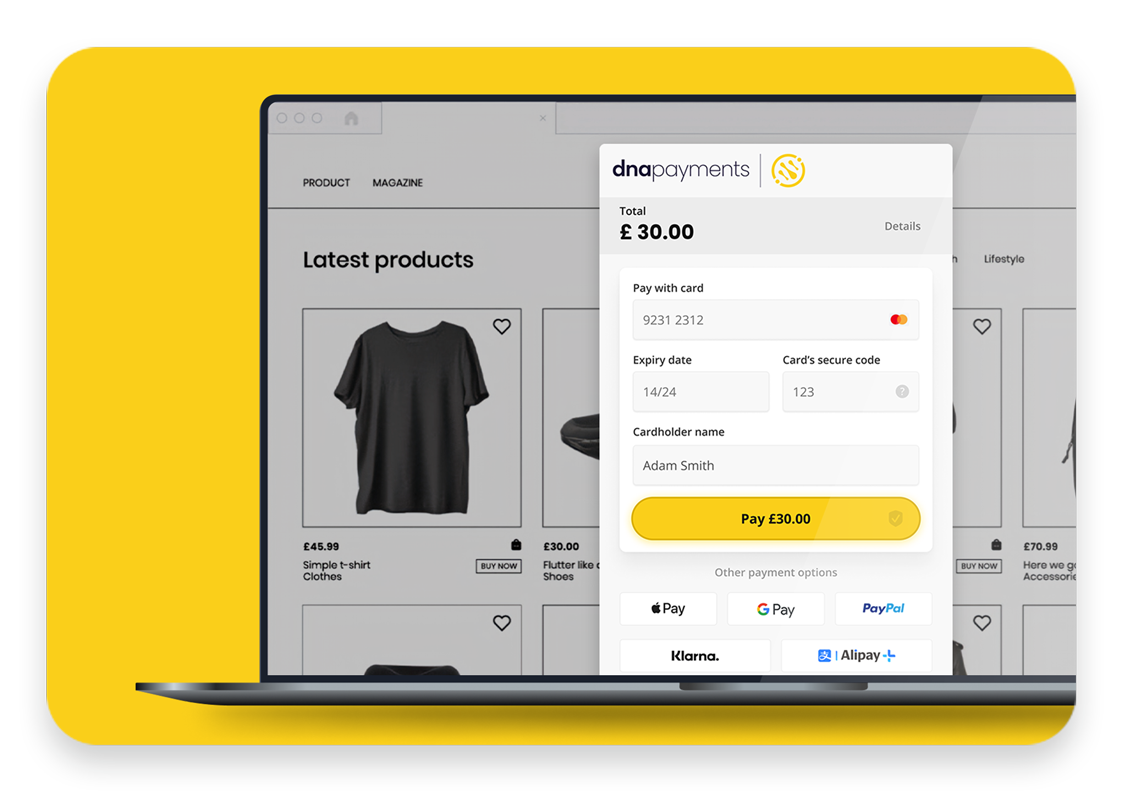

Merchants need a quick and secure authentication process compatible with modern mobile browsers. That's why all our online payments are 3DS v2 Compliant at their core, giving customers a streamlined process that meets the needs of a new era of convenient payments and reduces cart abandonment and checkout times.

With frictionless flow, payment authentication can be made in the access control server (ACS) without the customer's input, meaning fewer pop-ups, passwords and additional steps.

Our card acceptance methods meet the highest level of Payment Card Industry Data Security Standard (PCI DSS) requirements. We ensure maximum data security with every card transaction and align our Payment Solutions with card issuers' latest data security benchmarks.

Our PCI DSS Compliance provides peace of mind to merchants using our checkout and payment solutions. Customers' card data is highly secure, saving our merchants time and making PCI validation easier and quicker, so there's less friction in the onboarding process.

We've partnered with Signifyd as our integrated fraud security provider to increase our transaction intelligence, providing a precise measure of the level of risk involved with each order and a recommendation to ship it or not, depending on that risk. The high-quality decisions mean our merchant customers pass cleaner transaction traffic on to their banks, which is one key to keeping their authorisation rates high.

Signifyd is helping thousands of merchants avoid chargebacks, dramatically reduce false declines and eliminate manual review while demonstrating the ability to increase the number of approved orders by an average of 5% to 7%.

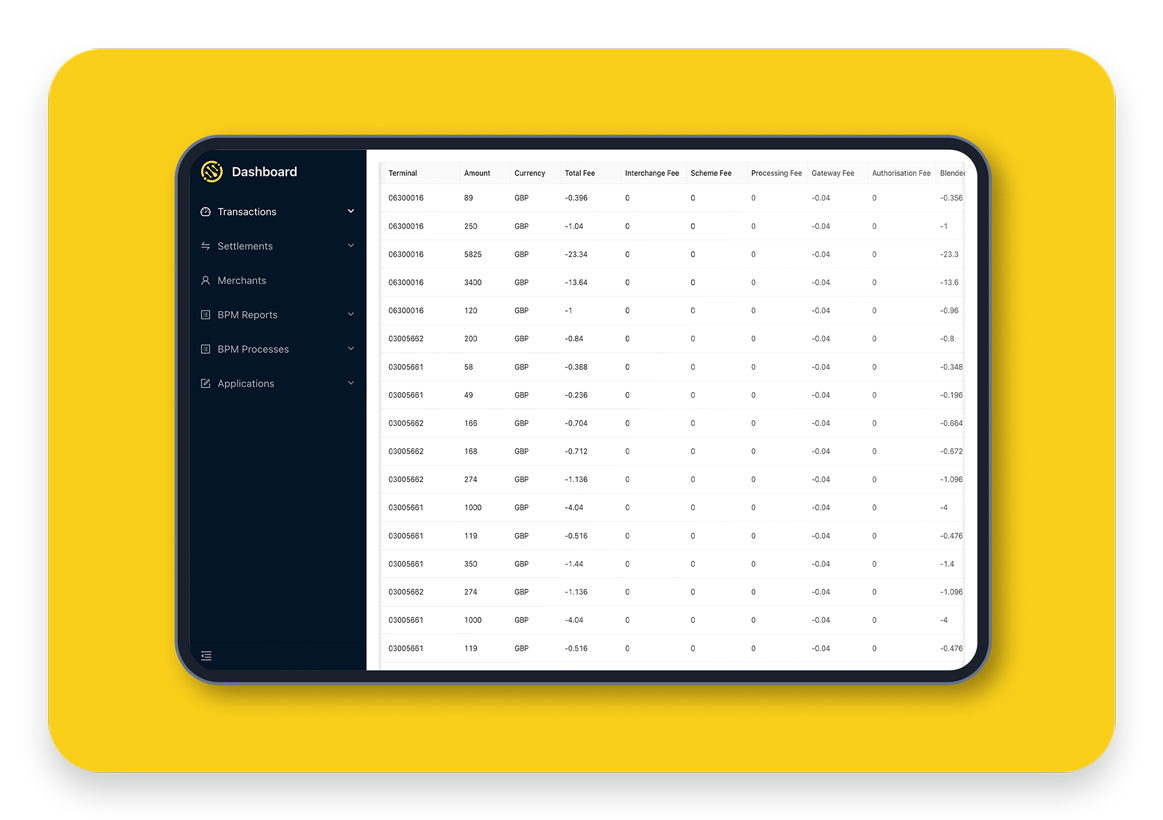

We're aware of all the risks involved with defaults and payment events, which is why we've got a robust and comprehensive payment risk strategy, procedures, rules and guidelines that help our merchants mitigate these risks while processing payments for peace of mind.

Although there is never a proper risk-free payment method, our automated monitoring solution detects all fraudulent activity across our ecosystem to mitigate fraud, chargebacks and unwanted activity.

Our Payment Solutions are all Point to Point Encryption (P2PE) v3 encryption standard approved to ensure our merchants' customers' card information is encrypted securely. Once payment is made, straight after the information is read at the payment terminal point of sale, the data then remains encrypted until it is processed.

We provide an all-in-one solution with all of our payments, which are all PCI compliant as standard, and validated to eliminate data breaches throughout the payment ecosystem.

Get in touch, and we'll happily provide additional details and guide you through 3DS v2 and how being with DNA Payments' acquiring can benefit your fraud security as a merchant